If you’re in the content or marketing business, you can’t go an hour, much less a day, without hearing something about connected TV (CTV), the nascent world of streaming services and support industries that grabbed American viewers’ attentions during the pandemic and never let go.

Hulu, Peacock, Disney+, Discovery+, as well as repackagers like Roku, Pluto TV are all becoming household names. Recent research also shows users gravitating more toward ad-supported versions, which are less expensive.

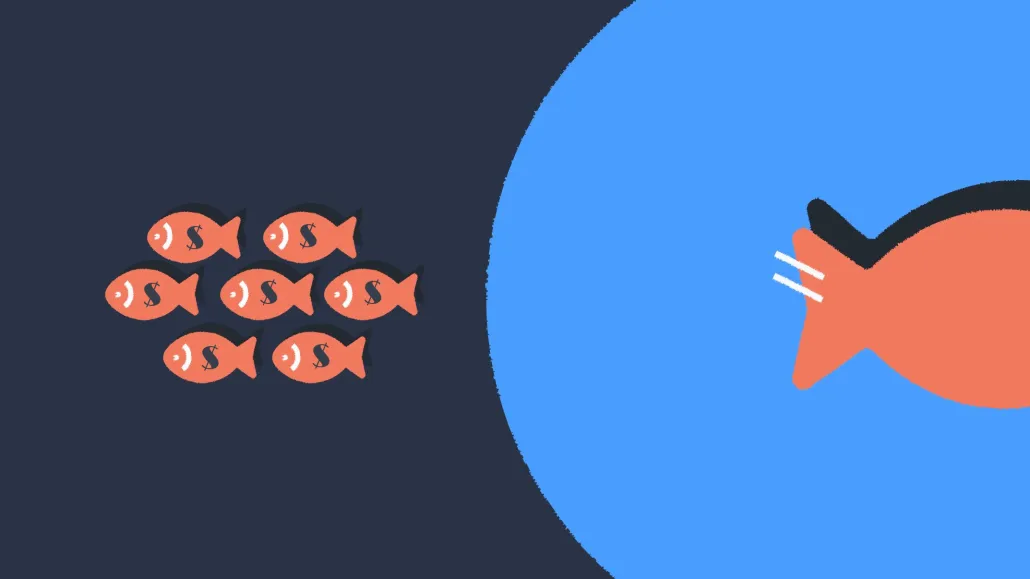

Given the rise in pricing on linear television in the 2021 upfront marketplace, this sounds like a dream opportunity for media planners and buyers to purchase TV time in streaming for their clients. But buyers say the reality is, CTV is in shambles, with multiple demand-side platforms selling the same inventory, rampant fraud and an inability to control ad placement. And the problem is expected to grow exponentially as CTV is forecast by eMarketer to attract $13.4 billion in ad revenue, almost 50% over 2020’s haul of just over $9 billion in 2020.

“If you’re using multiple DSPs, not only are you getting overlapping inventory, you’re also bidding against yourself! The problem is exacerbated right now because we’re seeing inventory levels are low,” said Brian Hovis, head of performance marketing at Traction, which dubs itself a marketing accelerator. “Net net, programmatic OTT will be part of your buy, but it’s no panacea that will help you reach your goals. And if you’re using multiple DSPs, stop!”

“You get this web of buying paths, so when you think about supply path optimization, it gets really messy,” said Ryan Eusanio, managing director of digital activation at Omnicom Media Group (OMG). “The selling ecosystem of the digital side of TV does not match what the linear side is currently operating on today. So we have to bridge that gap as best we can in order for those dollars to successfully match where the consumer is going.”

To that end, Digiday has learned that OMG is proposing a set of standards for CTV purchasing it hopes the rest of the media agency world will support, called The Connected TV Signal Standardization Initiative. It essentially lays out a set of investment practices and protocols to bring order to CTV’s messy house, through three primary avenues or “signals:”

Inventory standardization (getting CTV platforms to be more transparent with show, genre and placement data and involving third-party verification firms to validate the buys)

Identity standardization (moving toward household IDs and away from IP addresses, and coordinating data clean-room usage to connect first-party data)

Fraud prevention (introducing more transparency in the supply chain through the use of IAB Tech Lab’s ads.cert 2.0 security protocols)

OMG has lined up a mix of companies to support its initiative, including SSP Magnite, Yahoo and AMC Networks, as well as a verification partner it declined to identify, according to Eusanio. “Providing this kind of standardization and transparency around what’s being bought, who’s being reached and reducing ad waste are all things that are beneficial to the buy- and sell-sides and all the tech in the middle. This is one of those areas it’s not beneficial to be competitive in.”

The problem of content adjacency and buyers’ lack of control to determine it is real. “How do you accurately control for those?” asked Tony Marlow, CMO of Integral Ad Science, which tackles fraud and attribution for marketers. “How do you make sure that your ads are turning up in the places where they’re going to have the greatest impact and achieve the goals of the campaign? And not turning up where they either don’t represent your brand values or just simply don’t work that well for what you’re trying to achieve. That starts to get to not just the interoperability of the audience, but being able to control the context in a much more granular way than was ever possible with linear TV.”

Jason Fairchild, CEO of TV ad-tech buying and measurement firm tvScientific, said the problem lies with the multitude of DSP cluttering the CTV space right now. “It doesn’t have to be as hard as it is. If you approach the marketplace correctly with the right technical protections and the right buying approach, which is one-to-one curated deals, then you can get around almost all the issues,” he said.

One final issue IAS’ Marlow has with the current state of inventory management in CTV is the fact that there’s less premium inventory left once upfront commitments and programmatic deals have sucked up the best spots. “The effect that has is it locks up vast lots of the premium inventory and it constricts the availability of a lot of a lot of these impressions within the open market, and it’s still transacting this way. It means that inventory isn’t available to anyone else,” Marlow said.