November 16, 2023 | By Alison Weissbrot

EXCLUSIVE: Campaign gets a sneak peek into OMG’s 2024 strategy and compares its “Agency as a Platform” model with other holding company offerings aimed at simplifying clients’ experience.

As clients search for simplified solutions and holding companies look for growth, the latter are finding efficiencies and benefits in more closely knitting together their media agencies while strengthening the capabilities and brands of their parent networks.

Some, such as WPP’s GroupM and IPG Mediabrands, are consolidating and eliminating agency and specialist brands, while others, including Publicis Media and Dentsu Media, are putting legacy agency brands in the background in favor of bespoke, cross-agency solutions.

Omnicom Media Group (OMG) is landing somewhere in between. Its “Agency as a Platform” model, implemented by global CEO Florian Adamski in 2022, aims to provide clients the flexibility of working a la carte with the teams, tools and capabilities they want, while preserving the cultures and brands of its agencies and avoiding the tensions that often arise between brands once in direct competition with one another. The agencies are “powered” by the group’s engineering, product and technology teams at Omni and Annalect with technology and offshore specialist support.

Adamski laid out this vision at OMG’s first global town hall on Tuesday, Nov. 7, in which he and leaders from across the business provided an update on the strategy, direction and priorities of the business for roughly 24,000 staff tuning in around the world. Campaign US was given exclusive access to the town hall and executives in attendance.

He kicked off the nearly three-hour live stream acknowledging the tough geopolitical and economic context in which the business is operating.

We are in a tricky moment as it relates to geopolitics, economic pressures, companies coming out of an extended period of COVID and inflationary anomalies,” Adamski tells Campaign US in an interview after the event. “Now we’re seeing a lot of these companies normalizing both their bottom and top lines.”

Recent changes to the media agency model have been driven in part by a difficult economy, in which many holding companies are seeing their pandemic-era growth stall. WPP is putting GroupM at the center of a roughly $100 million savings drive, while IPG continues to wrestle with pullback from tech clients after a year of mass layoffs and underperformance at its digital agencies.

Omnicom has outperformed most of its peers in this environment, posting 3.3% YOY organic growth in its October Q3 earnings report, while IPG, WPP and Dentsu all declined. The group’s “advertising and media” unit, which includes OMG, grew 6.1% YOY off the back of media wins including Uber’s $600 million account and the retention of HSBC globally. The figures trail only Publicis Groupe, which grew organically 5.3% YOY in Q3.

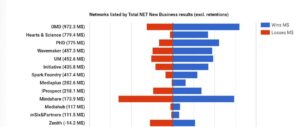

OMG, which manages $38 billion in billings across more than 110 markets, has led peers in net new business in 2023, ranking at the top of Comvergence’s net new business list released earlier this week at $2.6 billion, followed by Publicis at $2.3 billion and Mediabrands at $2 billion. OMD, PHD and Hearts & Science took the top three slots in the rankings.

And according to RECMA’s 2023 diagnostics report released in October, which evaluates agency performance against 19 criteria including pitch performance, data and analytics expertise and internal team structures over a three-year period, OMG increased its score by three points — more than any of its peers.

(Source: RECMA Diagnostics Network & Groups hierarchy report, October 2023)

Despite the momentum, Adamski remains cautious about the year ahead and wants the business to keep its foot on the gas pedal.

“There’s still pressure in economic growth by companies now trying to protect their bottom lines. There’s war, there’s conflict. Companies will be somewhat careful to budget for 2024 because of these uncertainties,” he says.

But he still sees an opportunity for OMG to steal market share from competitors. “I do believe we will outgrow the market,” he adds.

“Agency as a Platform”

At the core of OMG’s strategy is “Agency as a Platform,” its go-to-market plan for bringing together teams, capabilities and talent across the network to bear for clients.

The model is a fresh take on an approach holding companies have been working to implement for years as large, multinational clients desire simpler relationships with their agencies, as well as multifaceted skills. Publicis talks about the “Power of One,” while IPG calls it “Open Architecture.” WPP’s Open X, its solution to service Coca-Cola, is another high profile example of the approach.

“Agency as a Platform” can take a number of shapes. Some clients, including Apple and Mercedes, have dedicated agencies, while others, such as McDonald’s and PepsiCo, work with a collection of agencies. The likes of Warner Bros. Discovery and L’Oréal work in a hybrid in-house capacity.

Adamski estimates that, in 2024, half of all pitches OMG enters will “require a flexible ecosystem of talent, capabilities and technology.” In addition to being pan-regional or global, “the larger the business and the more disciplines in a client’s brief, the more likely it would be [an] Agency as a Platform [model],” he says.

(Source: Comvergence net new business rankings, November 2023)

According to Greg Paull, principal at R3, these bespoke agency models are a direct result of Procter & Gamble chief brand officer Marc Pritchard’s 2016 statement that “your complexity should not be our problem.”

But in practice, it can be difficult to align the egos and incentives of historically competitive agencies. Adamski says OMG places incentives on executives that ladder back up to the group’s success overall, versus just that executive’s agency.

But he adds it’s been “a journey” for everyone to understand these new incentive structures. “In the past, people were very much incentivized by seeing a direct correlation of their behavior into the next dollar earned,” he explains. “But, if you take a step back, that is very confined, because it might unlock $1 over here, but it might hinder $5 over there.”

Adamski’s executives appear to be on board, as “Agency as a Platform” was a common thread throughout presentations during the town hall. In an interview, Guy Marks, new global CEO of PHD, says cross-agency bickering “just doesn’t happen between us.”

“Sure, we all have bumps in the road, and sometimes things don’t go as smoothly. But the level of transparency, the level of collaboration we have between the different elements of the group — P&L isn’t something we trip over,” he explains.

And because OMG hasn’t undergone as much consolidation as its peers, it doesn’t face the same infrastructure challenges when executing on this model, Adamski says.

“We never had to cope with the challenge of having three different agencies come together and telling two of them their system is no longer working for us and it needs to be somebody else’s,” he adds.

At the same time, “Agency as a Platform” opens up an opportunity for OMG to strengthen its own brand as a place its agencies can rely on for expertise, tools or technology.

“When I grew up in OMD, the holding company was meaningless to me. It was anonymous. At the maximum, it is where the P&L buck ultimately would stop. They didn’t give me anything to help me thrive, grow and win,” Adamski says, indicating a desire to change that.

The role of agency brands

As these cross-agency models become more popular, agency networks must decide what role their agency brands serve. While Publicis has leaned heavily into bespoke client teams while keeping its brands, GroupM has sunset some brands while bolstering others and Dentsu has let its brands fade to the background.

OMG aims to have a bit of both. Adamski emphasizes the group’s commitment to preserving the OMD, PHD and Hearts & Science brands, maintaining that their unique processes and cultures bring a different lens to the tools and capabilities that power them.

Each of the agencies also have a different story. OMD, ranked as the largest global media agency by Comvergence, is enjoying the fruits of a turnaround over the past six years, while Hearts & Science and PHD have more work to do.

For Hearts & Science, that means staying ahead of the curve on performance marketing and growing globally; for PHD, it means embracing more data, digital and activation capabilities.

“We’re winning big, global pieces of business and competitive reviews. We know the technology is ready,” Marks says. “The challenge I have is making sure this incredible PHD agency team around the world is ready. Have they got the motivation, behaviors, mindset to adapt to this next era?”

(Source: Comvergence net new business rankings, November 2023)

However, cross-agency models have the potential to cause confusion for talent. While strong agency brands are a great way to attract staff, shuffling people onto new accounts based on client demands can leave them feeling disconnected from their teams and with a lack of clarity on reporting lines. This, in turn, can stifle career growth.

But on the contrary, PHD’s Marks argues, cross-agency collaboration can give staff more mobility across different departments, functions, clients and geographies and open them to new ways of thinking. “That talent mobility is hugely motivating for people,” he explains.

These models also create opportunities for holding companies to drive incremental margins, raising the concern of whether teams are actually designed in the best interest of clients or talent, according to two former holding company executives who spoke with Campaign US. An OMG spokesperson says that in “Agency as a Platform” relationships, client contracts sit with the lead agency, allowing it to avoid such conflicts.

Automation, in-housing and commerce

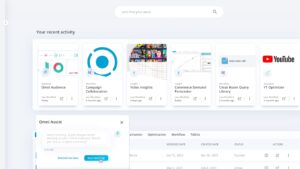

Key ingredients to “Agency as a Platform” are Annalect and Omni, OMG’s engineering talent hub and platform, respectively. Omni is used by 40,000 staffers across Omnicom, including 20,000 certified users as well as “hundreds of clients,” according to Annalect global CEO Slavi Samardzija. An OMG spokesperson said the vast majority of staff use Omni regularly.

The next phase is to continue to drive adoption of Omni across the network while training staff on new tools, such as AI-powered chatbot Omni Assist.

By creating a central resource for technology and data, Omni also allows OMG to embrace new models, such as supporting client in-house operations. According to Adamski, clients who choose to in-house still need help from specialists, whether they rent them from agencies or embed agency teams at their offices. They also still require agency leverage when negotiating larger deals.

Adamski sees opportunities to license Omni to clients as a platform that orchestrates their in-house marketing tech stacks, opening up a potential new revenue stream.

“We’ll see a split between managed service and self-service,” he continues. “It is quite new for agencies, because today they stand for managed service, full stop.”

Staff, meanwhile, seem eager to get their hands on new generative AI capabilities in Omni, such as automated audience insights, campaign workflow recommendations, performance capabilities and learning and development. Many asked during the town hall when they will get access to Omni Assist’s full capabilities.

(Source: Omnicom Media Group)

But Adamski is taking a tempered approach to unleashing the power of generative AI, first ensuring OMG employees are properly trained on how to use the technology and understand the risks it raises around privacy and IP. A steering committee at Omnicom is providing guidance on these issues.

“You need to truly understand its vast possibilities before you put it in the hands of thousands of people. We want to make sure we’re being responsible,” he says.

Another question when it comes to OMG’s technology strategy is the role of Flywheel, the digital commerce business Omnicom will purchase from Ascential for $900 million — marking its biggest acquisition. Staffers during the town hall asked what the Flywheel acquisition means for Transact, OMG’s commerce unit launched just over a year ago.

Adamski declines to speak to the Flywheel acquisition directly, emphasizing it hasn’t yet been finalized. But should it go through, Flywheel will bring to Omnicom more than 2,000 commerce specialists globally and a cloud platform with integrated commerce capabilities.

“It would be an exponential acceleration of what we can offer clients today,” he says.

Talent and offshoring

What may be a larger concern for staff is OMG’s increased focus on offshoring. It is expanding talent hubs in locations such as India, Latin America and Central Europe to support clients in a “24/7, follow the sun approach,” Adamski says.

Offshoring has been a key part of Annalect’s strategy since it launched in 2010, with Annalect India established as its first hub in 2012. Offshoring, an increasingly common practice in the ad industry, allows companies to save on costs by hiring staff in low-income locations, but can result in quality issues.

Samardzija says offshore teams are not disconnected from OMG but rather “intricately intertwined.” They provide a range of capabilities, from engineering and analytics to creative and even client-facing services.

“A majority of talent in [offshore hubs are] client-facing or client engaged,” adds OMD Worldwide CEO George Manas. “This is not an anonymous back office solution.”

According to Hearts & Science U.S. CEO Chris Stanger, offshoring allows OMG’s agencies to “extract core efficiency” in managing the “foundational and fundamental” elements of the business, freeing up onshore staff for the “higher-value, strategic work really driving our clients.”

However, Adamski recognizes that getting the balance right between onshore and offshore talent is crucial to the future of the business. “If you start offshoring everything … that would ultimately mean you do not bring young and fresh talent into the onshore agency,” he says.

As for onshore teams, the war for great talent is still ongoing. As of June, agency employment is at an all-time high. Finding talent in high-demand areas such as retail media, digital and data analytics in particular has been a struggle, Adamski says.

“The pressure for talent has never been never been larger than it is today,” he adds.

Manas echoes that sentiment, calling the talent market “tight” and “very, very competitive.” But he pointed to new hires such as Suhaila Hobba, who recently joined as OMD’s chief media officer, and Melissa Wisehart, who joined PHD as chief media officer, North America.

According to Manas, OMG has become a more attractive proposition for talent based on the diversity of services it is now able to offer. “They know that they’re going to have exposure to more senior clients, to more enterprise decisions from a marketing standpoint,” he explains.

in the global CEO role across all of OMG’s agencies.

Adamski says that, across the group, there are a number of women and diverse executives waiting “in the wings,” but did not provide a timeframe for when they might move into global leadership roles. In the U.S., this includes PHD U.S. CEO Mike Solomon, OMD U.S. CEO Christina Hanson and OMG North America CEO Ralph Pardo. He also pointed to Laura Fenton, who joined OMD U.K. as CEO in September, and Charlotte Lee, who is CEO of OMD APAC.

“If you look at the up-and-coming talent at OMG … we have a number of female and diverse talent in second-tier leadership [roles] ready to make the leap of a substance that, at least in the 26 years I’ve been in OMG, I’ve never seen before,” he says.