February 28, 2024 | By Parker Herren

Market data from ANA AIMM shows investment in diverse-owned media made up 2.5% of total ad spend in 2023. Although Black-owned media received the highest total investment, Asian-owned media saw investment grow the most in 2023.

Investment in diverse-owned media grew in 2023, though by far less than in the year prior as the industry navigates the long-term trajectory for growing the marketplace.

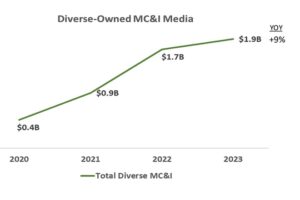

In total, ad dollars committed to diverse-owned media in 2023 increased to $1.9 billion, excluding programmatic advertising, from $1.7 billion committed in 2022, according to new research from the ANA’s Alliance for Inclusive and Multicultural Marketing (AIMM).

While investment continues to increase, this falls below the 88.9% increase from $900 million to $1.7 billion between 2021 and 2022. The data shows what some industry leaders are calling a level set from a rush in recent years to invest equitably in media, particularly Black-owned media.

In total, ad dollars committed to diverse-owned media in 2023 increased about 9% to $1.9 billion, excluding programmatic advertising.

Although Black-owned media received the highest total investment, Asian-owned media saw investment grow the most in 2023, increasing 25% year-over-year to $433 million. Investment in Black-owned media increased 6% to $991 million, and Hispanic-owned media saw an increase of 4% to $223 million.

Diverse-owned media still holds a small percentage of total ad spend, which is estimated at $76.3 billion (excluding programmatic) according to the Standard Media Index. From 2022 to 2023, diverse-owned media companies’ share of total ad spend grew from 2.3% to 2.5%; that number shrunk to 1.4% when only including companies that are both diverse-owned and produce content targeted for diverse audiences (for example, ReachTV, which is diverse-owned but programs for broad audiences watching airport TV screens, would not be included in the 1.4% figure).

The research was presented this week at AIMM’s GrowthFronts event, which brings together advertisers and diverse-owned media companies. The study factors in data from Media Framework, which logs publisher information such as ownership, and the Standard Media Index, which tracks ad spend across top holding companies and independent agencies.

The data reflects concern among diverse-owned media companies regarding slowed momentum in investment in the space. But agency executives see different trends playing out that reflect larger themes in modern media, including a re-evaluation of long-term investment strategies as well as a fragmenting market.

The market

The overall media market has been plagued by harsh conditions, with some buyers calling the current state of investment the softest in decades. But buyers have held strong in conversations over the past year that budgets allocated to diverse-owned media have not been the first cut as they might have been historically.

“From a multicultural perspective, [Omnicom Media Group] was able to buck the trend of overall investment being down,” said Michael Roca, executive director of Elevate, OMG’s arm focused on diverse media and marketing. “For diverse investment, we were up double digits in the marketplace.”

Another agency executive for diverse investment, who spoke to Ad Age on condition of anonymity, said their agency has quadrupled investments in diverse-owned media over the past two years. They said about 10% of their agency’s diverse-owned investment was done programmatically in 2023.

Agency executives argue that the smaller growth in 2023 compared to the two years prior is part of the process of evening out a long-term trajectory of growth for investment in diverse-owned media. “A lot of money began flowing their [diverse-owned media’s] way that before was non-existent or very small and some of them made projections that that was going to last forever,” the executive said. “Because many advertisers were not previously doing anything in this space, the first reaction of the industry was I need to do something, whatever that is. And now we are level setting what those numbers look like.”

The agency executive said that among some 250 diverse-owned media partners, about 10% are delivering on the terms of the client’s ad deals and benefiting through increased investment, while the rest are falling behind.

The goal for diverse-owned media partners is to invest in their growth beyond needing the support of budgets set aside for diverse-owned media, said Roca, who listed media companies such as Canella Media and Urban One among partners that can compete among any brand’s standard media plan.

“For many diverse-owned partners, they go out and tell a great story, but the delivery part and performance part is where we’re trying to help them, and to get them on par with other partners.” said Roca. “Some partners aren’t getting the investment that they want because they’re not yet at the performance level that typical media plans require.”