This article was originally published by Adweek.

(Clockwise from top): Florian Adamski, Chrissie Hanson, George Manas, Kristen Colonna, John Osborn, Scott Downs, Danielle Sporkin, Israel Mirsky, Monica Karo.

After suffering a string of client losses in 2016 and 2017, OMD managed a remarkable turnaround in 2018, going from the bottom to the top of COMvergence’s new business rankings over the course of a year.

But OMD Worldwide CEO Florian Adamski still couldn’t sleep at night.

“After year one of our internal transformation, I was highly paranoid,” he says. “The question that kept me up at night was whether the success we had seen in 2018 and early 2019 wasn’t highly dependent on a few individuals in this organization.”

So OMD got to work breaking down silos and establishing centralized leadership teams, “creating a process and unified technology that would democratize knowledge and capabilities” to ensure that “more offices were capable of delivering the same type of service over and over again,” he explains.

The agency’s determination to not rest on its laurels led it to implement a formula for repeatable success based on its “Better decisions, faster” positioning, utilizing Omnicom’s data platform Omni via its OMD Design system while bringing its global momentum to the U.S. in full force and leading Omnicom Media Group’s largest global pitch of the year. OMD was once again the agency to beat in 2019, leading COMvergence’s new business rankings and earning it the distinction of Adweek’s 2020 Global Media Agency of the Year, its second consecutive such honor and sixth since 2010.

Learning from failure

“The reality of new business is you’ve made a lot of promises and commitments, and in the modern-day media world, delivering those commitments is a tough thing,” says Adamski. “When [the agency’s leadership team] sat in early 2019 [at CES] in Vegas, we talked about how we could keep new business momentum and deliver on our promises.”

Client losses such as PetSmart and Signet, as well as feedback from current clients, made it clear the agency had to work more fluidly across the organization and deliver results faster for clients, particularly in the U.S.

“2018 and going into 2019, the most frustrating experience was [that it] took a long time until not only our organization internally believed but long-standing clients would actually truly see genuine change,” Adamski says.

Adds chief media officer George Manas, “The things that we were getting dinged on some of our losses were related to us not having a modern product. It felt very legacy,” something OMD diligently addressed in 2019.

OMD design

Introduced in 2018, OMD Design, a process utilizing data platform Omni that OMD U.S. CEO John Osborn called a “unique differentiator,” fully came to life last year.

“OMD was the agency within Omnicom that maximized tapping into Omni,” Adamski says.

Adamski explains that as a “homegrown, self-created platform” Omni stands apart from the wave of data acquisitions across the industry. Omni grew out of Annalect, the data-driven strategy division Omnicom launched in 2010.

OMD executive director, global technology and emerging platforms Israel Mirsky explained that what sets Omni apart is the overlap between its connected ID graph on consumer preferences and its proprietary inventory graph, as well as its ability to swap in and out data sets from different partners.

“In an average year, we bring onboard 2,500 to 3,000 people into the organization. We needed something that would give them the ability to operate this impactful set of instruments,” he explains, calling OMD Design “dynamic and fully integrated to the capabilities that sit within Omni.”

OMD Design guides users through every stage of the insight and planning process, democratizing access to Omni’s potential across the network.

OMD CSO Chrissie Hanson explained that OMD Design was modeled around “radical collaboration” and empathy, with the agency aiming for a deeper understanding of consumer perspectives transcending narrow category definitions.

It has proven a selling point in both new business pursuits and existing client relationships.

“OMD’s analytics has helped grow our insight into what drives effectiveness to make faster data-driven decisions about our marketing mix. They have helped us create more relevant connections with consumers by leveraging digital data with more precision, and they have supported the expansion of our ecommerce business by making it easier for people to discover and buy our brands online,” says John Burke, global brands president, CMO of Bacardi, which last year expanded its relationship with OMD to include Grey Goose. “The consistency of their product and service across all Bacardi markets has helped us grow our business.”

Mitsubishi Motors North America CMO Kimberley Gardiner adds that OMD’s collaborative approach helped the company take a “strategic leap” and focus on an “audience-centric approach and personalizing the experience across the entire consumer journey.”

Ancestry (Australia) | Armed with the insight that people’s interest in learning more about their ancestry is often triggered by milestone events such as marriage or starting a family, or as they face mortality, OMD worked to find people fitting these categories around the world and capture their stories of discovery. The approach led to a VTR (view through rate) of 237%—63% higher than any previous creative, a 128% increase in kit requests and six times the sales goal, with no additional budget.

Big structural change

In 2019, legacy structures remained as barriers to delivering “Better Decisions, Faster” for OMD.

“After the comeback we had last year, it was tough to maintain momentum,” Adamski notes. “We had gone through a lot of pain as a global network, and there was this readiness and willingness to make painful cuts and pivot to something new to make change happen.”

Perhaps the most painful of those cuts came early in 2020, when OMD USA moved away from its regional leadership structure, eliminating a series of presidencies in the process.

Osborn stressed the move had nothing to do with personalities, but instead reflected necessary structural changes to future-proof the agency.

“We needed to break from the past and what was a legacy setup and way of working to modernize how we show up and how we drive growth on behalf of our clients,” he says.

That legacy structure dated back to when OMD was formed by pulling media services out of Omnicom agencies BBDO New York, DDB Chicago and TBWA Los Angeles.

Osborn explained that client desires to “reduce friction” and simplify its structure helped spark the changes, which helped OMD deliver faster results and consistency across regional offices.

“We needed to show up as one OMD,” he says.

OMD also revised the way it adds and develops personnel, after what Osborn described as a “talent drain” from 2016 to 2017.

“We knew we had to capture an unfair share of better talent. Some of it was sitting inside OMD—it just hadn’t been propped up and discovered. Some of it we knew we had to bring in from outside,” he says, citing U.S. head of integrated planning Danielle Sporkin joining the agency from Essence as a prime example of the latter, in a role supporting Kristen Colonna, who had been promoted to CSO for North America.

“All pitches now place a huge emphasis on talent and our ability to develop our talent and bring the best talent to the fore,” says OMD Worldwide chief marketing officer Damian Winstanley. “Without that talent at the heart of that change, we were never going to see momentum continue.”

OMD hired Aurelie Binisti as U.S. director of talent and human resources in July and launched a new onboarding platform called Onstage. It also migrated around 450 employees from Omnicom digital programmatic group Resolution and data group Annalect into its account teams, including Manas.

“That was a bold move, if you look at how other agencies have just made cosmetic changes,” Manas says. “This was a truly structural change that put digital and data more at the core of the OMD product to deliver on the promise of ‘Better decisions, faster.’”

Manas and Osborn then implemented a Client Leadership Team function, a client-centric structure comprising business-minded experts managing client business, led by COO Scott Downs. They followed this by rolling out Client-Level Financial Tracking, providing client leaders a cross-departmental view of their business as well as an Accountability Framework assessing the data and digital maturity of its client service model, and centralizing service and product development under OMD’s Central Practices Organization.

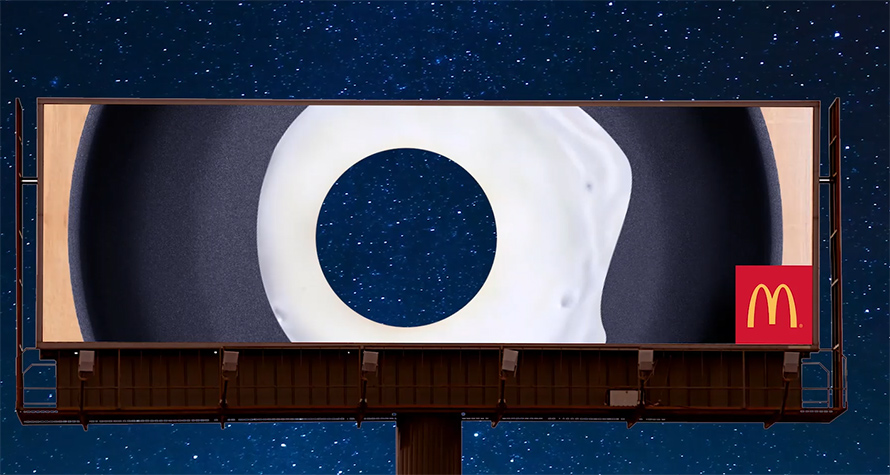

‘Meegnificent Billboard’ | Created for McDonald’s Puerto Rico, ‘Meegnificent Billboard’ centered on a custom-size billboard strategically aligned with the sun to create an eclipse effect. The man-made ‘astrological event’ was streamed on Facebook, and the event was tied to a free breakfast promotion. Teasers drove audiences to livestream the eclipse, directing them to show it at the counter for the free breakfast promotion. Over 11,000 people watched ‘Meegnificent Billboard’ live, leading to more than 2,300 breakfast offers claimed, a 10% sales increase, 20% engagement rate and 74% reach.

While 2018 saw consistent global growth for OMD, the U.S. lagged behind.

Osborn explains that the U.S. Army awarding Omnicom a 10-year contract, with OMD leading media, in late 2018 was a “game changer” for OMD that built momentum for 2019.

By the time the NFL drafted OMD to handle its media account in August, it was clear that OMD USA had a winning playbook.

OMD ended the year on a high note, leading the pitch for OMG’s bespoke OMG23 media unit for Disney, which concluded with OMG23 winning the North America movie studio’s account, as well as the majority of media channels in North America.

“All of the big pitches ask agencies to run through a data and analytical deep-dive session,” Adamski says, adding that with Disney, “We spent half of the time, if not more, talking through the ability to take first-party data and match it with third-party data in different environments, to drive a more effective, insightful Disney journey.”

The next decade

OMD has centered its Business Transformation offering, which Osborn calls a “secret weapon,” on a group of mar-tech and ad-tech consultants focused on partnering with client leads and OMD’s planning and investment departments to find the right data and tech strategies.

The consultative service offering allows OMD to keep up with trends such as in-housing and competition from consultancies.

“We’re not just talking to the media lead but have a line into the chief technology officer, the chief information officer,” Manas says.

OMD Design, meanwhile, continues to progress.

“It’s never done,” says Hanson, citing a goal for predictive functionality and a more quantitative approach to empathy mapping. “We’ve always got to make it smarter, better.”

Key wins

Disney (North America; Fox and media channels), $1.2 billion/$600 million incremental; NFL (U.S.), $200 million; Yili (China), $117 million; Allianz (42 markets), $100 million; Müller (German retailer), $100 million; Boehringer Ingelheim (10 markets), $70 million; Beiersdorf (Nordics), $60 million; Telenor (Norway telecom), $55 million; Zain (Middle East telecom), $55 million; King (U.S. gaming), $40 million; Snap (global), $15 million.

Key losses

Signet (U.S.), $228 million; Edeka (Germany), $150 million; Disney (EMEA), $100 million; PetSmart (U.S.), $85 million; Levi’s (Americas), $74 million; Bosch (Germany), $60 million.

Strategic moves

Eliminated regional president roles in OMD USA. Migrated 400 specialists who had been serving OMD USA clients within Omnicom Media Group’s performance marketing and data analytics agencies to seats on OMD’s account teams. Appointed George Manas chief media officer. U.S. CEO John Osborn and Manas launched a Client Leadership Team function within OMD, led by OMD COO Scott Downs. Implemented Client-Level Financial Tracking. Centralized service and product development under the Central Practices Organization. Hired Danielle Sporkin as U.S. head of integrated planning. Hired Benson Hausman as managing director, business development. Promoted Tracy Quitasol to director of marketing and innovation.

Revenue

Around $1.4 billion, an increase of around 6% over 2018, according to industry estimates.